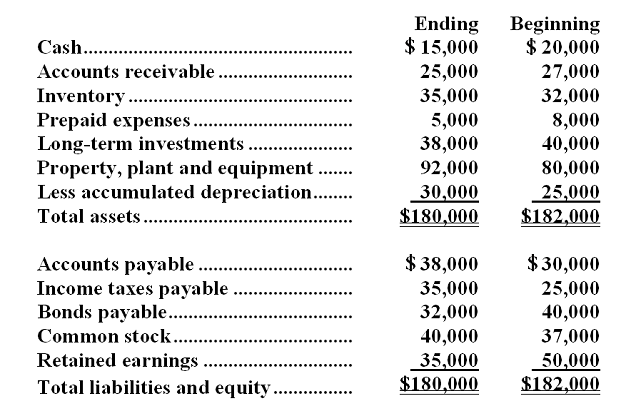

Alkine Company's comparative balance sheet appears below:  Alkine reported the following net income for the year:

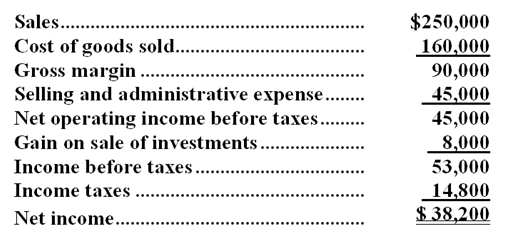

Alkine reported the following net income for the year:  Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

Dividends were declared and paid during the year. A gain of $8,000 was recorded on the sale of the long-term investments. The company did not purchase any long-term investments or dispose of any property, plant, and equipment during the year. It also did not issue any bonds payable or repurchase any of its own common stock.

-Under the direct method,the cost of goods sold adjusted to a cash basis would be:

Definitions:

Contribution Margin

Contribution margin is the revenue remaining after subtracting variable costs, used to cover fixed costs and generate profit, highlighting the profitability of individual products.

Business Segments

Parts or divisions of a company that operate within distinct markets or industries, often reported separately in financial statements for analysis.

Common Fixed Expenses

Overhead costs that are incurred regardless of the level of production or sales, shared by multiple products or departments.

Common Fixed Expenses

Fixed costs shared across different departments or product lines, such as rent or administrative salaries, not directly tied to any one aspect of business operations.

Q6: In a sell or process further decision,which

Q21: A box with an open top

Q23: Verhague Corporation's net cash provided by operating

Q40: Sales reported on the income statement totaled

Q59: How many minutes of milling machine time

Q81: When a camera flash goes off,

Q111: If the new equipment is purchased,the present

Q128: At what selling price per unit should

Q135: Issuing new shares of stock in a

Q136: In comparing two investment alternatives,the difference between