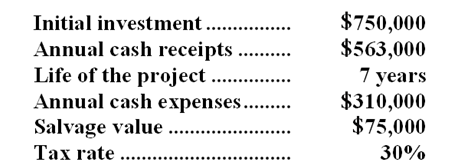

Burry Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

-When computing the net present value of the project,what are the annual after-tax cash expenses?

Definitions:

Reportable

Pertains to information or data that must be disclosed or submitted to a governing body or authority according to regulations.

Cabinets Segment

A specific business unit within a company that focuses on the production and sale of cabinetry.

Operating Profit

Income from a company's core business operations, excluding deductions of interest and taxes, as well as non-operational income like investments.

Property Taxes

Taxes imposed on property owners based on the assessed value of their property, typically levied by local governments.

Q4: The immediate cash outflow required for this

Q4: When computing the net present value of

Q6: Ring Corporation uses a discount rate of

Q12: The release of working capital at the

Q36: The ending and beginning balances of Parma

Q48: The accounts receivable turnover for Year 2

Q103: The company has received a special,one-time-only order

Q111: If the new equipment is purchased,the present

Q122: What is the net advantage or disadvantage

Q128: Assume straight-line depreciation and no salvage value.The