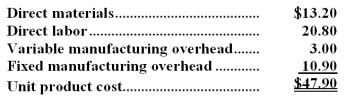

Foulds Company makes 10,000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $42.30 a unit.If the company accepts this offer,the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $39,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $42.30 a unit.If the company accepts this offer,the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $39,000 per year.

If the part were purchased from the outside supplier,all of the direct labor cost of the part would be avoided.However,$6.40 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a.How much of the unit product cost of $47.90 is relevant in the decision of whether to make or buy the part?

b.What is the net total dollar advantage (disadvantage)of purchasing the part rather than making it?

c.What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 10,000 units required each year?

Definitions:

Marketing Message

A specific idea or theme that marketing campaigns are designed to communicate to a target audience.

Photograph

A visual image captured by recording light or other electromagnetic radiation, either digitally or on a light-sensitive material.

Behavioral Targeting

A marketing approach that uses web user information to strengthen advertising campaigns by targeting specific audiences.

Online Behavior

The way individuals act and interact in digital environments, including activities on social media, browsing habits, and communication patterns on the internet.

Q2: In determining the dollar amount to use

Q6: (Ignore income taxes in this problem. )Virani

Q7: Assume that the Peanut Butter Division of

Q59: What was the West Division's residual income

Q67: The following standards for variable manufacturing overhead

Q67: Spring Company has invested $20,000 in a

Q97: If the internal rate of return is

Q128: At what selling price per unit should

Q132: A labor efficiency variance resulting from the

Q132: A very useful guide for making investment