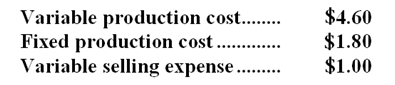

The Immanuel Company has just obtained a request for a special order of 6,000 jigs to be shipped at the end of the month at a selling price of $7 each. The company has a production capacity of 90,000 jigs per month with total fixed production costs of $144,000. At present, the company is selling 80,000 jigs per month through regular channels at a selling price of $11 each. For these regular sales, the cost for one jig is:  If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

-Suppose that regular sales of jigs total 85,000 units per month.All other conditions remain the same.If Immanuel accepts the special order,the change in monthly net operating income will be:

Definitions:

Risk-Free Asset

An investment that is considered to have negligible risk of financial loss, typically government bonds of stable countries.

Capital Allocation Line

A line representing the risk-return trade-off of different portfolios, showing the highest expected return for a given level of risk.

Standard Deviation

A measure of the dispersion or variation in a set of values, indicating how much the values differ from the mean of the set.

Complete Portfolio

A portfolio that includes both risky assets and a risk-free asset, optimizing the balance between risk and return.

Q6: (Ignore income taxes in this problem. )Virani

Q28: The net cash provided by (used in)financing

Q32: The fixed manufacturing overhead volume variance as:<br>A)$7,500

Q40: (Ignore income taxes in this problem. )Blaine

Q66: An avoidable cost is a cost that

Q80: (Ignore income taxes in this problem. )Dunay

Q133: (Ignore income taxes in this problem. )The

Q139: (Ignore income taxes in this problem. )Janes,Inc.

Q143: The variable overhead efficiency variance for November

Q150: Lafountaine Manufacturing Corporation has a standard cost