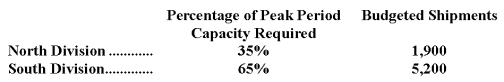

Zindell Corporation has two operating divisions-a North Division and a South Division.The company's Logistics Department services both divisions.The variable costs of the Logistics Department are budgeted at $33 per shipment.The Logistics Department's fixed costs are budgeted at $369,200 for the year.The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year,actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720.The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.

At the end of the year,actual Logistics Department variable costs totaled $307,050 and fixed costs totaled $374,720.The North Division had a total of 3,900 shipments and the South Division had a total of 5,000 shipments for the year.

Required:

a.Prepare a report showing how much of the Logistics Department's costs should be charged to each of the operating divisions at the end of the year.

b.How much of the actual Logistics Department costs should not be charged to the operating divisions at the end of the year? Who should be held responsible for these uncharged costs?

Definitions:

Receivables

Money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Modified Accelerated Cost Recovery System (MACRS)

A method of depreciation used for tax purposes in the United States that allows businesses to recover investments in certain property over a specified life through annual deductions.

Tax Deductions

Expenses that can be subtracted from gross income to reduce taxable income and overall tax liability.

Half-Year Convention

The half-year convention is a tax and accounting principle that allows for depreciation of assets to be calculated as if they had been in service for half a year, regardless of when they were actually acquired during the fiscal year.

Q8: Division P of Turbo Corporation has the

Q10: The labor rate variance for June is:<br>A)$238

Q11: Suppose that Division A has ample idle

Q20: Last year the sales at Seidelman Company

Q21: Wahlen Corporation has provided the following data

Q41: The net cash provided by (used in)operating

Q46: When the actual direct labor-hours is less

Q81: Leerar Corporation makes a product with the

Q81: Zollars Cane Products,Inc. ,processes sugar cane in

Q92: Foulds Company makes 10,000 units per year