Warehouse Services is a service department in the Werner Company,providing storage service to three operating departments.The company charges the costs of this department to operating departments on the basis of cubic feet occupied.

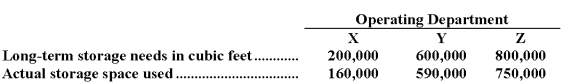

Last year,Warehouse Services budgeted variable storage cost of $0.15 per cubic foot occupied.The budgeted total fixed cost was $120,000,and was determined by the long-term storage needs of the operating departments.Actual storage space occupied during the year,along with long-term storage needs of operating departments,is given below:

Actual variable storage costs amounted to $0.16 per cubic foot occupied.Actual fixed storage costs were $123,000.

Required:

a.Compute the amount of variable storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

b.Compute the amount of fixed storage cost that should be charged to each operating department at the end of the year for performance evaluation purposes.

Definitions:

Initial Cost

The initial expense of acquiring an asset, including purchase price, setup, and preparation costs.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated to depreciation expense since the asset was put into use.

Gain Or Loss

The financial result that occurs when the selling price of an asset differs from its purchase price, either positive (gain) or negative (loss).

Initial Cost

The purchase price or construction cost of an asset or investment, not accounting for depreciation or amortization.

Q3: Consider a company that has only variable

Q4: The variable overhead rate variance for May

Q19: Scuderi Corporation has two operating divisions-an Inland

Q33: The materials quantity variance for November is:<br>A)$7,530

Q33: To record the purchase of direct materials,the

Q34: The simple rate of return would be

Q65: The throughput time was:<br>A)4.2 hours<br>B)9.5 hours<br>C)30.6 hours<br>D)26.4

Q67: Net operating income in Year 2 amounted

Q143: The variable overhead efficiency variance for November

Q162: The materials quantity variance for April is:<br>A)$7,348