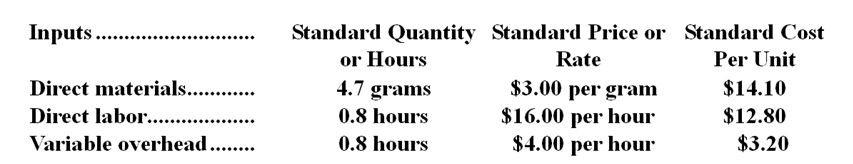

Tidd Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in November.

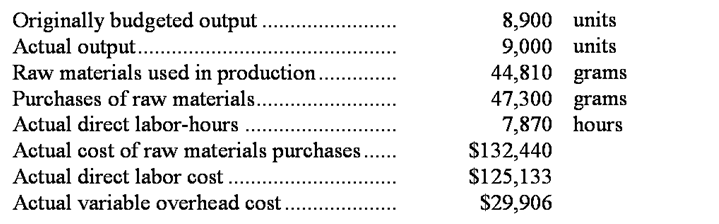

The company reported the following results concerning this product in November.  The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The materials quantity variance for November is:

Definitions:

Tax Benefits

Financial advantages granted by taxing authorities, reducing the tax liability for individuals or businesses, often used to promote certain behaviors or investments.

Demonstrable Tasks

Tasks that can be easily shown, proven, or validated through practical demonstration or evidence.

Decision Fatigue

A psychological state where a person's ability to make decisions deteriorates due to the mental exhaustion from making numerous decisions.

Behavioral Consequence

refers to the result or outcome that follows a specific behavior, influencing future behavior through reinforcement or punishment.

Q2: For performance evaluation purposes,variable costs of service

Q5: The labor rate variance for February is:<br>A)$825

Q35: Accounts payable at the end of December

Q38: The variable overhead rate variance for March

Q67: Net operating income in Year 2 amounted

Q87: The labor rate variance is:<br>A)$480 F<br>B)$480 U<br>C)$440

Q90: The materials quantity variance is:<br>A)$800 U<br>B)$4,000 U<br>C)$760

Q130: The materials price variance for October is:<br>A)$620

Q135: The net operating income in the planning

Q262: The spending variance for direct materials in