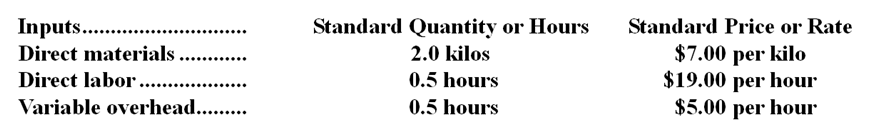

Landram Corporation makes a product with the following standard costs:  In March the company produced 4,700 units using 10,230 kilos of the direct material and 2,210 direct labor-hours. During the month, the company purchased 10,800 kilos of the direct material at a cost of $76,680. The actual direct labor cost was $38,233 and the actual variable overhead cost was $11,934.

In March the company produced 4,700 units using 10,230 kilos of the direct material and 2,210 direct labor-hours. During the month, the company purchased 10,800 kilos of the direct material at a cost of $76,680. The actual direct labor cost was $38,233 and the actual variable overhead cost was $11,934.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for March is:

Definitions:

BCG Matrix

BCG Matrix is a strategic business tool developed by the Boston Consulting Group to help organizations analyze and make decisions about their product portfolio, classifying products into four categories: Stars, Cash Cows, Question Marks, and Dogs.

Strategic Decisions

High-level, directional choices made by an organization to achieve long-term objectives and secure competitive advantage.

BCG Matrix

The BCG Matrix is a strategic planning tool that helps organizations evaluate their product portfolio based on market growth and market share, categorizing them into four quadrants.

Cash Cows

Business units or products that generate significant cash flows with little investment, typically in a mature stage of their lifecycle.

Q1: For performance evaluation purposes,budgeted service department costs,instead

Q3: The unit product cost of product V47Q

Q19: The selling and administrative expense budget of

Q31: Variable manufacturing overhead is applied to products

Q34: The wages and salaries in the planning

Q38: Zindell Corporation bases its budgets on the

Q97: To attain its desired ending cash balance

Q136: The labor rate variance for March is:<br>A)$3,757

Q140: What is the lowest selling price per

Q268: While fixed costs should not be affected