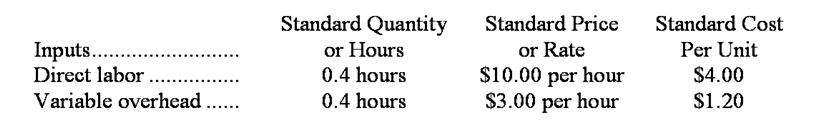

Mazzo Corporation makes a product with the following standards for direct labor and variable overhead:  In February the company's budgeted production was 5,000 units, but the actual production was 5,100 units. The company used 2,090 direct labor-hours to produce this output. The actual variable overhead cost was $6,688. The company applies variable overhead on the basis of direct labor-hours.

In February the company's budgeted production was 5,000 units, but the actual production was 5,100 units. The company used 2,090 direct labor-hours to produce this output. The actual variable overhead cost was $6,688. The company applies variable overhead on the basis of direct labor-hours.

-The variable overhead efficiency variance for February is:

Definitions:

Traditional Costing System

An accounting method that applies indirect costs to products based on a predetermined overhead rate, without distinguishing between activities or processes.

Manufacturing Overhead

All indirect manufacturing costs, encompassing expenses such as maintenance, utilities, and salaries not directly tied to specific units produced.

Activity-Based Costing

Activity-Based Costing is an accounting method that assigns costs to products or services based on the activities they require.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead to individual products or job orders based on a specific activity base, such as machine hours.

Q9: Fixed service department costs should be charged

Q29: The net operating income in the flexible

Q52: Gaucher Corporation has provided the following data

Q54: Soderquist Corporation uses residual income to evaluate

Q57: The direct materials quantity variance for May

Q61: The amount of fixed manufacturing overhead cost

Q80: The net operating income in the planning

Q156: If the labor efficiency variance is unfavorable,then<br>A)actual

Q157: The materials quantity variance for June is:<br>A)$1,760

Q224: Seard Clinic uses patient-visits as its measure