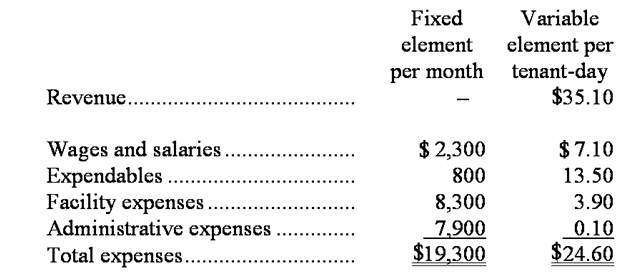

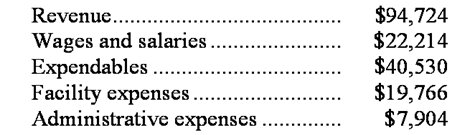

Goodfriend Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During June, the kennel budgeted for 2,800 tenant-days, but its actual level of activity was 2,840 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for June:

Data used in budgeting: Actual results for June:

Actual results for June:

-The expendables in the flexible budget for June would be closest to:

Definitions:

Charitable Deduction

A tax deduction given for donations made to qualifying charitable organizations.

Estimated Payment

Payments made to cover taxes on income not subject to withholding, like earnings from self-employment, often paid quarterly to avoid underpayment penalties.

Subchapter S Corporation

A Subchapter S Corporation is a form of corporation that meets specific Internal Revenue Code requirements, allowing it to pass income directly to shareholders and avoid double taxation.

Corporate Net Income

The amount of profit a company has earned during a specific period after all expenses, taxes, and costs have been subtracted from total revenue.

Q3: The Labor Efficiency Variance for May would

Q7: What would be the total overhead cost

Q7: The total number of units produced in

Q13: The medical supplies in the flexible budget

Q23: The variable overhead rate variance for June

Q25: The expendables in the flexible budget for

Q45: In the journal entry to record the

Q82: The labor efficiency variance for June is:<br>A)$995

Q95: Irie Corporation has an activity-based costing system

Q170: The expendables in the flexible budget for