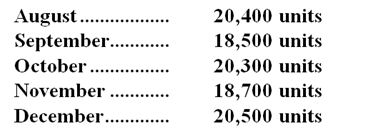

Casper Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 3.5 kilograms of the raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows:  The company wants to maintain monthly ending inventories of Jurislon equal to 10% of the following month's production needs. On July 31, this requirement was not met since only 6,900 kilograms of Jurislon were on hand. The cost of Jurislon is $3.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.

The company wants to maintain monthly ending inventories of Jurislon equal to 10% of the following month's production needs. On July 31, this requirement was not met since only 6,900 kilograms of Jurislon were on hand. The cost of Jurislon is $3.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.

-The desired ending inventory of Jurislon for the month of September is:

Definitions:

Product Cost

The total of direct materials, direct labor, and manufacturing overhead expenses incurred in producing a product.

Differential Cost

The difference in total cost that will result from selecting one alternative over another.

Fixed Cost

A recurring cost that does not vary with output or sales volume, including expenses like leases and insurance that remain constant no matter the business activity level.

Value Basis

The underlying value on which something is assessed or calculated, often referring to how assets, liabilities, or equity are valued in financial statements.

Q5: Bustle Manufacturing Corporation has a traditional costing

Q8: Kapoor Corporation uses the following activity rates

Q18: The budgeted direct labor cost per unit

Q31: The activity variance for administrative expenses in

Q54: Colasuonno Corporation has two divisions: the West

Q82: A proposal has been made that will

Q105: How much of the raw material should

Q107: Pressler Corporation's activity-based costing system has three

Q157: Hassick Corporation produces and sells a single

Q230: The variable expense per unit is $12