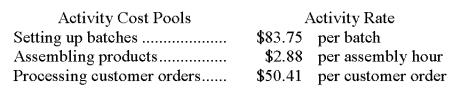

Kapoor Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

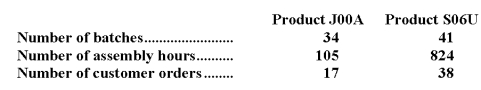

Data concerning two products appear below:  Required:

Required:

a.How much overhead cost would be assigned to Product J00A using the company's activity-based costing system? Show your work!

b.How much overhead cost would be assigned to Product S06U using the company's activity-based costing system? Show your work!

Definitions:

Turning Schedule

A care plan that outlines the frequency and method of repositioning a patient to prevent pressure ulcers and promote circulation.

Stage/Category III

A classification degree used in various contexts, often indicating a moderate to severe level of condition or assessment.

Primary Intention

A method of healing where wounds are closed directly, typically with sutures, staples, or adhesive, allowing for quicker and more cosmetic healing.

Secondary Intention

A wound healing process where the wound is left open to heal naturally from the inside out, often resulting in larger scar formation.

Q14: In the first step of the allocation,the

Q53: The costs of a particular department should

Q60: The cost of December merchandise purchases would

Q83: Personnel administration is an example of (an):<br>A)Unit-level

Q90: The activity variance for net operating income

Q113: How much overhead cost is allocated to

Q116: During October,Keliihoomalu Clinic budgeted for 2,700 patient-visits,but

Q120: If Store G sales increase by $40,000

Q179: The administrative expenses in the planning budget

Q199: Penury Company offers two products.At present,the following