Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

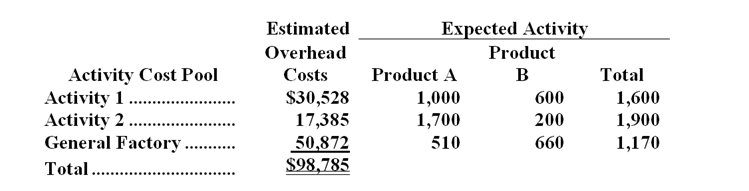

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the traditional costing system is closest to:

Definitions:

Evaluate

The process of assessing or examining something to determine its value, quality, importance, extent, or condition.

Customer Feedback

Pertains to the information, insights, and opinions provided by customers about their experience with a company's products or services.

Positioning Strategies

Techniques used by businesses to place their products or services in the market so that they stand out to potential customers.

Competitive Advantage

An advantage that a company has over its competitors, allowing it to generate greater sales or margins and/or attract & retain more customers.

Q3: The variable overhead efficiency variance for supplies

Q19: The activity rate for the Supervising activity

Q41: Craft Company produces a single product.Last year,the

Q68: How much overhead cost is allocated to

Q79: One benefit of budgeting is that it

Q95: Whit Catering uses two measures of activity,jobs

Q148: The overall revenue and spending variance (i.e.

Q173: The activity variance for net operating income

Q187: Hansen Company produces a single product.During the

Q214: The direct materials in the flexible budget