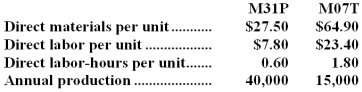

Stoughton Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,M31P and M07T,about which it has provided the following data:

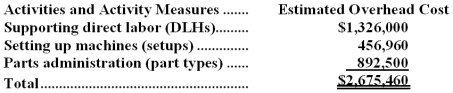

The company's estimated total manufacturing overhead for the year is $2,675,460 and the company's estimated total direct labor-hours for the year is 51,000.

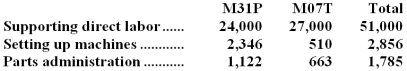

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b.Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Definitions:

Tariff

A governmental policy tool used to control the flow of international trade through taxes on imports and exports.

Saddles Imported

The act of bringing in saddles from foreign countries for sale within the domestic market.

Quantity

The amount or number of a material or immaterial good or service.

Tariff

A tax imposed by a government on imported goods, often used to protect domestic industries and adjust trade balances.

Q34: What is the overhead cost assigned to

Q40: The activity variance for personnel expenses in

Q50: Capp Corporation is a wholesaler of

Q100: To facilitate decision-making,fixed expenses should be expressed

Q102: If the fixed expenses increase in a

Q119: The materials quantity variance for March is:<br>A)$5,810

Q125: The total cost at the activity level

Q127: How much indirect factory wages and factory

Q132: Roy Corporation produces a single product.During July,Roy

Q176: Under variable costing,the unit product cost would