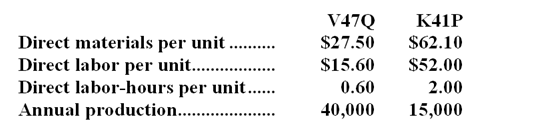

Solum Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, V47Q and K41P, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

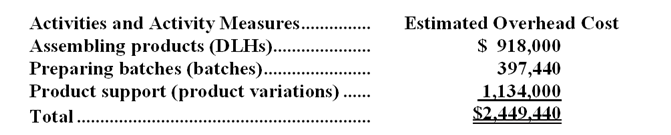

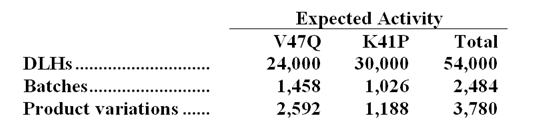

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product K41P under the activity-based costing system is closest to:

Definitions:

Job Satisfaction

The extent to which individuals feel fulfilled and content with their occupation and work environment.

Response Bias

A tendency of survey participants to answer questions in a manner that does not accurately reflect their true feelings or opinions.

Patriotic

Having or expressing devotion to and vigorous support for one's country.

Armed Conflict

A contested incompatibility that concerns government and/or territory where the use of armed force between two parties results in at least 25 battle-related deaths in one calendar year.

Q8: On a CVP graph for a profitable

Q8: Schoeppner Corporation uses customers served as its

Q13: In segment reporting,sales dollars is usually an

Q18: The budgeted direct labor cost per unit

Q40: Fastic Corporation makes a product with the

Q57: If Store Q sales increase by $30,000

Q58: The company's contribution margin ratio is closest

Q74: The manufacturing overhead budget at Cutchin Corporation

Q154: The product line segment margin for Product

Q243: The net operating income in the planning