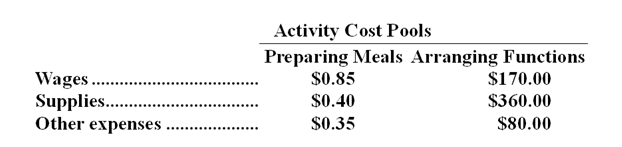

Groenen Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:  The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 120 meals were served. The company catered the function for a fixed price of $20.00 per meal. The cost of the raw ingredients for the meals was $13.05 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost.

-According to the activity-based costing system,what was the total cost (including the costs of raw ingredients) of the function mentioned above? (Round to the nearest whole dollar. )

Definitions:

Conspicuous Statement

A statement or notice that is made to stand out clearly and be easily noticed, often requiring a specific form of presentation to ensure visibility.

Negotiable Instrument

A document guaranteeing the payment of a specific amount of money, either on demand or at a set time, with the payee’s name written on the document.

Negotiability

The characteristic of a financial instrument that allows it to be transferred or assigned from one party to another, facilitating commerce and trade.

Electronic Deposit

The transfer of funds directly into a bank account, eliminating the need for physical checks.

Q1: According to the activity-based costing system,what was

Q2: A company has provided the following data:

Q15: The unit product cost under variable costing

Q22: What is the overhead cost assigned to

Q34: What is the overhead cost assigned to

Q139: Would the following costs be classified as

Q140: Montgomery Corporation produces and sells a single

Q148: Roberts Company produces a single product.This year,the

Q162: The materials quantity variance for April is:<br>A)$7,348

Q176: Schlager Corporation makes a product with the