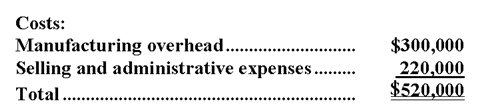

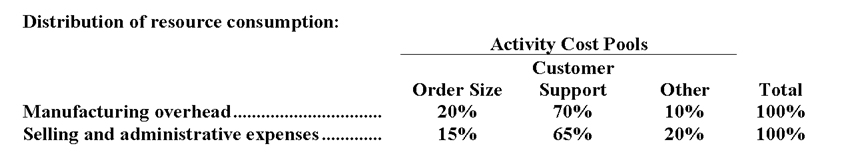

Dillner Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

Definitions:

Taxes

Compulsory financial charges imposed by a government on individuals and organizations to fund public expenditures.

Disposable Income

Money left after taxes and social security contributions have been subtracted, which can be either spent or saved according to personal preference.

Aggregate Spending

The total spending in an economy, including consumption, investment, government expenditures, and net exports.

Discretionary Fiscal Policy

The deliberate manipulation of government purchases, taxation, and transfer payments to promote macroeconomic goals, such as full employment, price stability, and economic growth

Q10: Deschambault Inc.is working on its cash budget

Q24: What is the product margin for Product

Q26: Parkins Company produces and sells a single

Q76: The activity variance for selling and administrative

Q134: Reach Consulting Corporation has its headquarters in

Q138: Onofre Tech is a for-profit vocational school.The

Q167: Sugiki Corporation has two divisions: the Alpha

Q181: This question is to be considered independently

Q229: Data concerning Lantieri Corporation's single product appear

Q269: The spending variance for laundry costs in