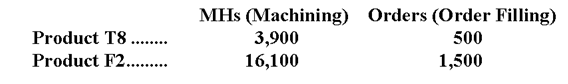

Pedroni Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

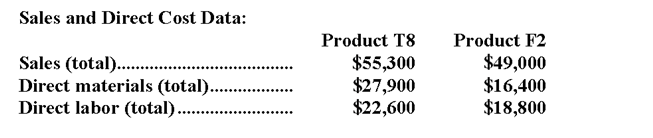

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the product margin for Product F2 under activity-based costing?

Definitions:

Q19: Mancuso Corporation has provided its contribution format

Q23: Under absorption costing,the ending inventory for the

Q33: If sales for Division F increase $40,000

Q48: The unit product cost under absorption costing

Q50: Socha Memorial Diner is a charity supported

Q65: The September cash disbursements for manufacturing overhead

Q70: A properly constructed segmented income statement in

Q179: Stephen Company has the following data for

Q187: Hansen Company produces a single product.During the

Q208: The net operating income in the planning