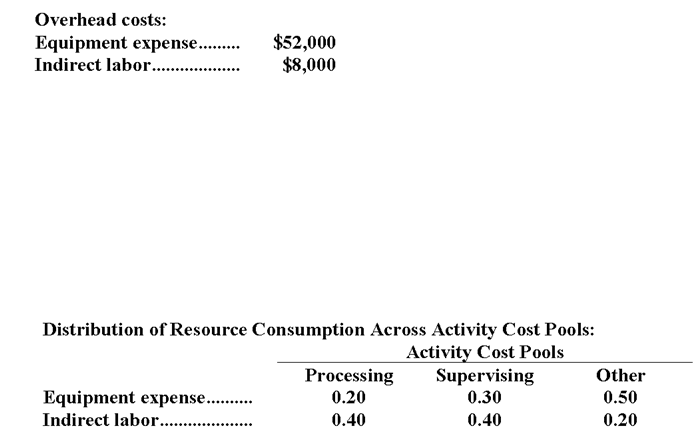

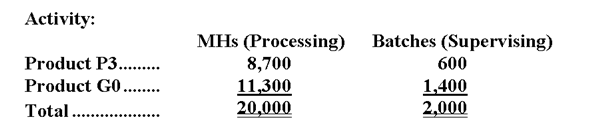

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

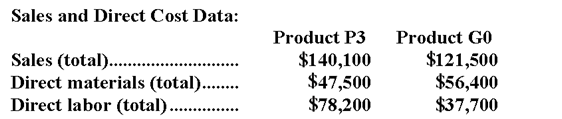

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Informational Reports

Documents that provide facts and data without analysis or recommendations, intended to inform the reader about a specific topic.

Yardstick Approach

Logical argumentation approach that uses a number of criteria to evaluate one or more possible solutions.

Logical Arguments

Reasoning structured in a way that follows principles of logic, typically involving premises that lead to a conclusion.

Hypothesis

A potential explanation that needs to be tested.

Q22: The revenue variance for October would be

Q57: If Store Q sales increase by $30,000

Q109: The activity variance for administrative expenses in

Q132: What is the company's unit contribution margin?<br>A)$2.00<br>B)$0.32<br>C)$4.30<br>D)$2.30

Q152: Net operating income for the company was:<br>A)$166,000<br>B)$256,000<br>C)$334,000<br>D)$46,000

Q194: The spending variance for plane operating costs

Q214: What is the company's unit contribution margin?<br>A)$4.70<br>B)$0.42<br>C)$2.15<br>D)$2.55

Q231: The net operating income in the flexible

Q248: The total fixed cost at the activity

Q274: The selling and administrative expense in the