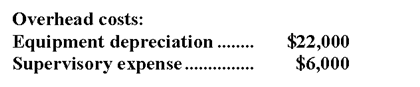

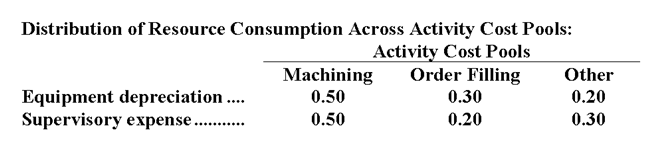

Brisky Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

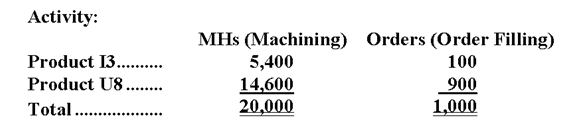

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

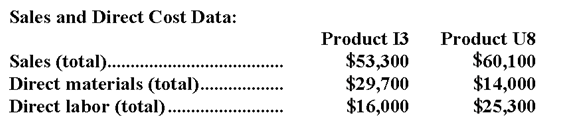

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the overhead cost assigned to Product I3 under activity-based costing?

Definitions:

Net Present Value

A calculation that compares the value of a dollar today to the value of that same dollar in the future, taking inflation and returns into account to analyze the profitability of investments.

Profitability Index

A financial metric that measures the relative profitability of an investment, calculated as the present value of future cash flows divided by the initial investment cost.

Annuity

A financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees.

Net Present Value

Net Present Value (NPV) is a financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time, used to assess the profitability of an investment.

Q8: Kapoor Corporation uses the following activity rates

Q16: Rider Company sells a single product.The product

Q45: The activity rate for Activity 2 is

Q117: Schmeider Corporation uses the following activity rates

Q148: Roberts Company produces a single product.This year,the

Q149: Shiraki Corporation produces and sells a single

Q164: The unit product cost under variable costing

Q169: The following information pertains to Clove Co.:

Q176: Under variable costing,the unit product cost would

Q195: The spending variance for occupancy expenses in