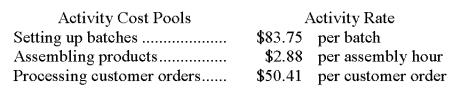

Kapoor Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

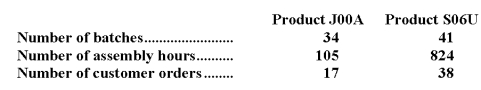

Data concerning two products appear below:  Required:

Required:

a.How much overhead cost would be assigned to Product J00A using the company's activity-based costing system? Show your work!

b.How much overhead cost would be assigned to Product S06U using the company's activity-based costing system? Show your work!

Definitions:

Cash Flows

The net amount of cash being transferred into and out of a business, especially affecting operating, investing, and financing activities.

Bank Loan

A type of loan provided by banks to individuals or businesses with an agreement to repay the borrowed amount along with interest over a specified period.

Operating Activities

business activities directly related to producing and delivering goods and/or services, which are the primary source of revenue for the company.

Fixed Assets

Long-term tangible assets held for business use and not expected to be converted into cash in the upcoming year.

Q8: Last year,Teneyck Corporation's variable costing net operating

Q14: The unit product cost of product K41P

Q34: What was the absorption costing net operating

Q56: The break-even point in sales dollars is:<br>A)$470,000<br>B)$180,000<br>C)$420,000<br>D)$561,000

Q89: Assuming that all of the costs listed

Q104: If the materials handling cost is allocated

Q122: Brandewie Corporation bases its budgets on the

Q140: The revenue variance for October would be

Q251: The spending variance for wages and salaries

Q269: The spending variance for laundry costs in