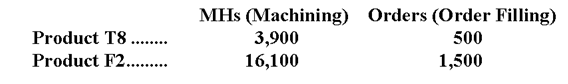

Pedroni Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

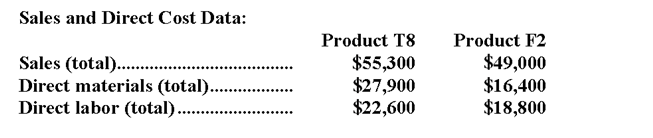

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

Definitions:

Competitive Price-searcher

A market condition where firms have some control over their pricing due to differentiated products, leading to a search for competitive prices.

Low Barriers

Conditions that make it easy for new firms to enter an industry, often leading to increased competition.

High Barriers

Referring to the substantial obstacles that prevent new competitors from easily entering an industry or market.

Economic Profit

The financial gain achieved when revenues exceed the total opportunity costs, including both explicit and implicit costs.

Q2: The total fixed cost at the activity

Q9: What is the overhead cost assigned to

Q24: Assume Grand uses the direct allocation method.After

Q46: December cash disbursements for merchandise purchases would

Q68: The revenue variance for September would be

Q74: For the month referred to above,net operating

Q97: Cayouette Clinic uses patient-visits as its measure

Q113: How much overhead cost is allocated to

Q158: The carrying value on the balance sheet

Q250: The administrative expenses in the planning budget