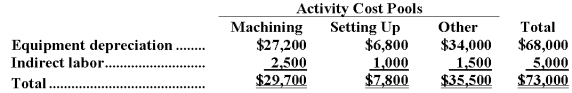

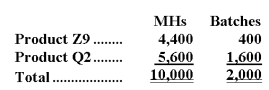

Narayan Corporation has an activity-based costing system with three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs,which consist of equipment depreciation and indirect labor,have been allocated to the cost pools already and are provided in the table below.  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs appear below:

Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

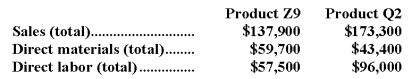

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c.Determine the product margins for each product using activity-based costing.

Definitions:

Capital Markets Efficiency Act of 1996 (CMEA)

A hypothetical act, as no specific details of such legislation are found under this title as of my last update.

State Registration

The process required in some jurisdictions for businesses or professionals to officially file their details with a state authority to legally operate or offer services within that state.

Qualified Purchasers

Investors who are deemed ‘qualified’ based on their financial assets, enabling them to participate in certain kinds of private investment opportunities not available to the general public.

Proxy

A person authorized to act on behalf of another person, especially in the context of voting rights in a meeting or election.

Q10: The spending variance for power costs in

Q15: In the first step of the allocation,the

Q48: The administrative expenses in the planning budget

Q80: What is the company's break-even sales in

Q86: A properly constructed segmented income statement in

Q88: The revenue variance for April would be

Q101: If the company plans to sell 670,000

Q132: Murri Corporation has an activity-based costing system

Q151: Chapnick Clinic bases its budgets on the

Q152: During March,Samorano Clinic plans for an activity