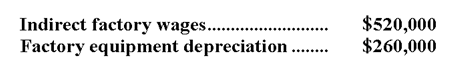

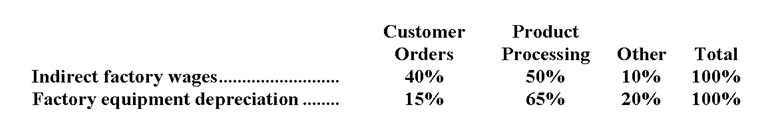

Lehner Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

Activity Cost Pools  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

-How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

Definitions:

Process Cost System

An accounting method used to track costs in manufacturing environments where products are indistinguishable from each other and produced in a continuous flow.

Custom Cabinet

A storage unit designed and built to meet the specific dimensions and style preferences of a customer.

Paper Mill

A factory that produces paper and paper products from raw materials such as wood pulp.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production based on a certain activity base.

Q9: The manufacturing overhead that would be applied

Q29: Olis Corporation sells a product for $130

Q30: How much cost,in total,would be allocated in

Q49: Assuming that the company charges $534.11 for

Q72: What is the overhead cost assigned to

Q83: Personnel administration is an example of (an):<br>A)Unit-level

Q93: Rothe Company manufactures and sells a single

Q137: What is the total period cost for

Q200: The spending variance for supplies cost in

Q217: The company's overall contribution margin ratio for