Hugle Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Machining,Setting

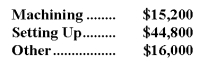

Hugle Corporation's activity-based costing system has three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:

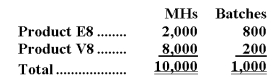

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:  Additional data concerning the company's products appears below:

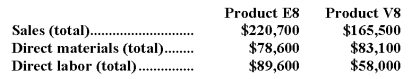

Additional data concerning the company's products appears below:  Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c.Determine the product margins for each product using activity-based costing.

Definitions:

Large-Scale Study

A research study that involves a large number of participants or observations, enabling more robust and generalizable findings.

Kinsey's Methodologies

Research techniques used by Alfred Kinsey and his team in the mid-20th century to study human sexual behavior through interviews and surveys.

Sexual Activity

Refers to any behavior that stimulates sexual arousal, pleasure, or gratification between individuals.

Janus Report

A comprehensive report on human sexual behavior published in the early 1990s, providing valuable insights into the sexual practices and attitudes of American adults at the time.

Q4: Krasnow Inc. ,which produces a single product,has

Q11: Inskeep Draperies makes custom draperies for homes

Q39: The spending variance for supplies costs in

Q41: Flinders Company has two service departments,Factory Administration

Q116: Kendall Company has sales of 1,000 units

Q118: The occupancy expenses in the flexible budget

Q157: Under absorption costing,the cost of goods sold

Q182: Swem Corporation makes a product that sells

Q226: During May,Hiles Corporation budgeted for 31,000 customers,but

Q239: The activity variance for net operating income