Demora Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Fabricating,Setting

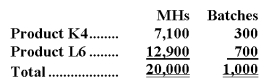

Demora Corporation's activity-based costing system has three activity cost pools-Fabricating,Setting Up,and Other.The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Proposition

A statement or assertion that expresses a judgment or opinion, which can be true or false.

Sweet

A taste sensation often associated with sugar and substances that evoke a similar pleasurable experience.

Predicate

The segment of a sentence or clause that includes a verb and makes a statement regarding the subject.

Wooden Floor

A type of flooring made from timber, known for its durability, natural appearance, and warmth, offering various styles and finishes.

Q6: If a cost object such as a

Q69: The FIFO method provides a major advantage

Q70: Guagliano Corporation produces and sells a single

Q120: Data concerning Odum Corporation's single product appear

Q124: A segment is any portion or activity

Q130: Roskam Housecleaning provides housecleaning services to its

Q160: Cuffee Inc. ,which produces a single product,has

Q163: The administrative expenses in the planning budget

Q254: The personnel expenses in the planning budget

Q294: The selling and administrative expenses in the