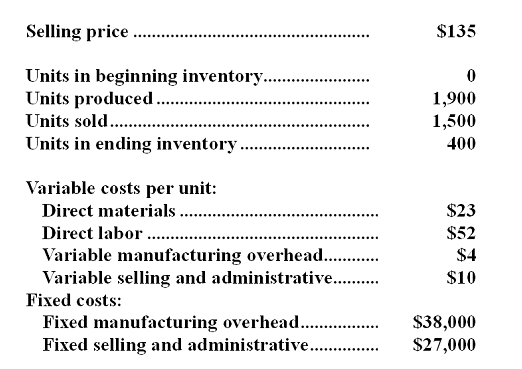

Ingerson Company, which has only one product, has provided the following data concerning its most recent month of operations:

-What is the net operating income for the month under variable costing?

Definitions:

Progressive Tax Structure

A taxation system where tax rates increase as the taxable amount increases, resulting in higher income earners paying a larger percentage of their income in taxes.

Marginal Tax Rates

The rate at which an additional dollar of income would be taxed, which varies based on income levels and is a fundamental component of progressive tax systems.

Average Tax Rates

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), indicating the percentage of income that goes to taxes.

Unemployment Compensation

Financial payments made to individuals who have lost their job through no fault of their own, intended to provide a temporary source of income.

Q10: Which of the following statements concerning ease

Q29: What is the overhead cost assigned to

Q30: Konosh Medical Clinic has two service departments,Building

Q70: If Nyman Company uses the weighted-average cost

Q77: Findt & Thompson PLC,a consulting firm,uses an

Q79: How much indirect factory wages and factory

Q79: Fixed costs that are traceable to a

Q111: What is the unit product cost for

Q149: A manufacturing company that produces a single

Q152: Loren Company's single product has a selling