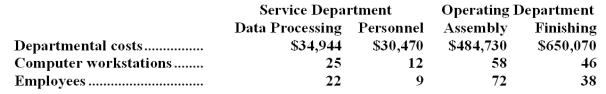

Amorim Corporation uses the direct method to allocate service department costs to operating departments.The company has two service departments,Data Processing and Personnel,and two operating departments,Assembly and Finishing.  Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

Data Processing Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees.The total amount of Data Processing Department cost allocated to the two operating departments is closest to:

Definitions:

List Price

The advertised or published price of a product or service before any discounts or deductions are applied.

Annual Property Taxes

Taxes assessed on property ownership, levied annually based on the property's assessed value.

Real Estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water.

Title Fees

Costs associated with the transfer of ownership or the establishment of rights to a property.

Q11: Essex Consultancy uses the direct method to

Q11: Executive Training,Inc. ,provides a personal development

Q28: Internal failure costs result when a defective

Q52: The journal entry to record the incurrence

Q65: Kharbanda Corporation uses the FIFO method in

Q75: The work in process inventory at the

Q78: The journal entry to record the allocation

Q87: A company should use process costing,rather than

Q88: Simoneaux Corporation bases its predetermined overhead rate

Q148: The cost of direct materials used in