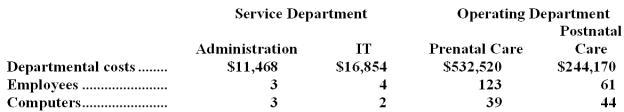

Chrisler Natal Clinic uses the step-down method to allocate service department costs to operating departments.The clinic has two service departments,Administration and Information Technology (IT),and two operating departments,Prenatal Care and Postnatal Care.  Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Administration Department costs are allocated first on the basis of employees and IT Department costs are allocated second on the basis of computers.

Required:

Allocate the service department costs to the operating departments using the step-down method.

Definitions:

Nonrefundable Credit

A tax credit that can only reduce a taxpayer’s liability to zero, but unlike refundable credits, any excess is not paid out to the taxpayer.

Adoption Credit

A tax benefit offered to taxpayers to offset some costs of legally adopting a child, which can reduce tax liability.

Foreign Tax Credit

A non-refundable tax credit for income taxes paid to a foreign country, aimed at reducing double taxation of the same income.

Born In

Generally refers to the place or country where an individual was born.

Q11: If the company bases its predetermined overhead

Q19: In November,one of the processing departments at

Q19: Using the least-squares regression method,the estimate of

Q42: The following journal entry would be made

Q45: The total Finishing Department cost after allocations

Q53: The cost of ending work in process

Q67: Assume the company's monthly target profit is

Q103: Fellner Corporation produces a single product and

Q185: The unit product cost under absorption costing

Q203: The break-even in sales dollars for the