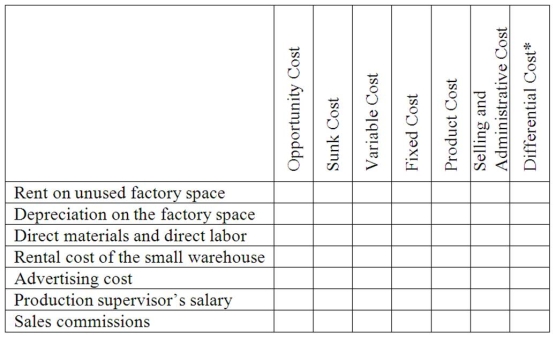

Laco Company acquired its factory building about 20 years ago.For a number of years the company has rented out a small,unused part of the building.The renter's lease will expire soon.Rather than renewing the lease,Laco Company is considering using the space itself to manufacture a new product.Under this option,the unused space will continue to be depreciated on a straight-line basis,as in past years.

Direct materials and direct labor cost for the new product would be $50 per unit.In order to have a place to store finished units of the new product,the company would have to rent a small warehouse nearby.The rental cost would be $2,000 per month.It would cost the company an additional $4,000 each month to advertise the new product.A new production supervisor would be hired to oversee production of the new product who would be paid $3,000 per month.The company would pay a sales commission of $10 for each unit of product that is sold.

Required:

Complete the chart below by placing an "X" under each column heading that helps to identify the costs listed to the left.There can be "X's" placed under more than one heading for a single cost.For example,a cost might be a product cost,an opportunity cost,and a sunk cost;there would be an "X" placed under each of these headings on the answer sheet opposite the cost.  *Between the alternatives of (1)renting the space out again or (2)using the space to produce the new product.

*Between the alternatives of (1)renting the space out again or (2)using the space to produce the new product.

Definitions:

Prosocial Behavior

Positive, constructive, helpful behavior. The opposite of antisocial behavior.

Classical Conditioning

A training process in which two stimuli are repeatedly coupled; the response that first comes from the second stimulus, in the end, comes from the first stimulus without the second.

Mirror Neurons

Neurons that fire both when an individual acts and when the individual observes the same action performed by another, thought to be fundamental in learning through imitation and in understanding the intentions of others.

Pick Up A Spoon

This is not a psychological or widely recognized key term in any academic field.

Q7: Aldot Candy Corporation is implementing a

Q16: The cost of ending work in process

Q24: Depreciation is always considered a product cost

Q24: If the company bases its predetermined overhead

Q27: Alam Company is a manufacturing firm that

Q29: What would be the total appraisal cost

Q49: Warvel Corporation's management has found that every

Q61: During August,Allee Corporation incurred $64,000 of actual

Q91: What are the equivalent units for conversion

Q155: Electrical costs at one of Vanartsdalen Corporation's