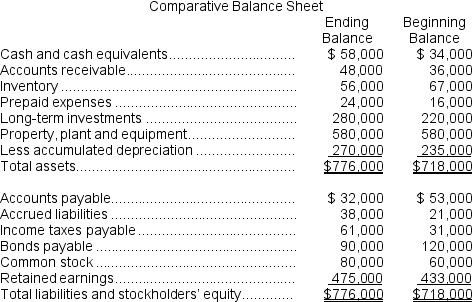

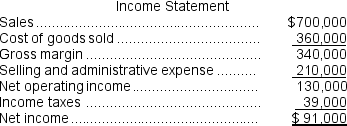

(Appendix 14A) Van Beeber Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the cost of goods sold adjusted to a cash basis would be:

Definitions:

Profit Centre Manager

An individual responsible for a division or segment of an organization whose performance is measured in terms of profitability.

Investment Centre Manager

A manager responsible for a business unit that is judged on its investment, revenue, and cost performance.

Revenue Centre Manager

A position responsible for generating revenue and overseeing the activities and strategy that contribute to revenue generation for a specific department or area.

Investment Centre Manager

An executive who is responsible for the profitability and efficient use of assets within a defined business segment or division.

Q4: T1-1B CRITICAL CARE SERVICE<br>Dr. Sutton, emergency room

Q7: AUDIT REPORT T6.2 ANGIOPLASTY/STENT<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg" alt="AUDIT

Q13: If all four of Argo Corporation's overhead

Q26: Up to how much should the company

Q30: A catering service has contracts with a

Q49: Kirsch,Inc. ,manufactures a product with the following

Q50: A company has a standard cost system

Q64: If the denominator level of activity is

Q65: What was the variable overhead rate variance

Q86: Kuhlman Corporation applies manufacturing overhead to