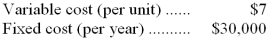

The Buffalo Division of Alfred Products, Inc. has the capacity to manufacture 10,000 units of a certain part each year. This part sells for $12 per unit on the outside market. The Albany Division of Alfred Products, Inc. buys 3,000 units of this part each year from Buffalo, and thus far has paid the market price. Harlow Company (an outside supplier) has recently offered to sell Albany 3,000 units per year of the same part. Buffalo Division's costs relating to the product are:

-Suppose that the Albany Division buys the 3,000 units from the outside supplier at a price of $10 per unit. Also suppose that the Buffalo Division can sell 10,000 units on the outside market. As a result of Albany shifting its purchases to the outside supplier, the yearly net operating income of Alfred Products, Inc. as a whole will:

Definitions:

Financial Lease

A lease agreement where the lessee assumes most of the risks and rewards of ownership, often with an option to purchase the asset at the end of the lease term.

Operating Lease

A lease agreement allowing a company to use an asset without owning it, typically with shorter terms than a finance lease.

Financial Lease

A type of lease in which the lessee has use of the asset for a significant portion of its useful life, and the lease payments are designed to cover the lessor's initial costs.

Debt-Equity Ratio

A financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets.

Q7: (Ignore income taxes in this problem. )You

Q8: When computing the net present value of

Q12: When analyzing a mixed cost,you should always

Q15: A pledge is something delivered as security

Q17: The management of Archie Corporation would

Q32: The key objective when performing substantive procedures

Q44: The two key assertions for inventory are

Q53: Sharp Company has a process costing

Q67: The management of Archut Corporation would

Q71: Harris Company uses a standard cost