Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

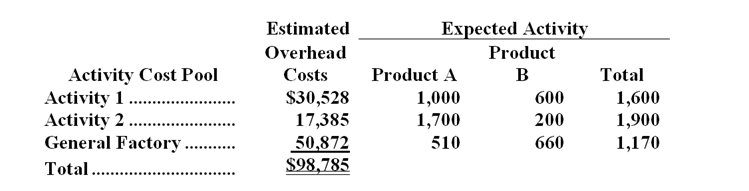

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Bondholder

An investor who owns bonds issued by corporations or governments, thereby lending money to the issuer in return for periodic interest payments and the return of principal at maturity.

Annual Coupon Rate

The interest rate a bond pays its holder, expressed as a percentage of its face value and payable annually.

Bond

A fixed-income instrument that represents a loan made by an investor to a borrower, typically corporate or governmental, which includes terms regarding the interest rate and when the loaned funds (bond principal) must be paid back (maturity).

Effective EAR

The Effective Annual Rate is the actual return on an investment, taking into account the effect of compounding interest.

Q1: Mccatty Inc.maintains a call center to

Q1: Suppose an action analysis report is prepared

Q5: Which of the following would be classified

Q11: The net cash provided by (used in)financing

Q20: Stamp Printing Corp. ,a book printer,has

Q33: Reigel Corporation is about to launch a

Q51: The cost of ending work in process

Q51: Control risk is assessed to be low

Q64: Using the weighted-average method,the cost per equivalent

Q65: What are the equivalent units for conversion