Shininger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, G27U and W21K, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

The company's estimated total manufacturing overhead for the year is $985,440 and the company's estimated total direct labor-hours for the year is 24,000.

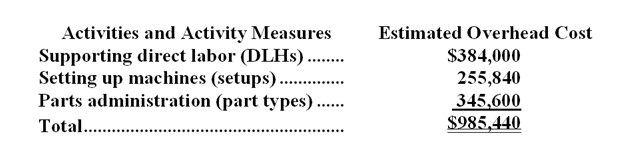

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product W21K under the activity-based costing system is closest to:

Definitions:

Development Costs

Development costs are expenses associated with the creation and design of new products or services, including research and development.

Breakeven Point

The level of production or sales at which total costs equal total revenue, meaning no net loss or gain is incurred.

Fixed Costs

Costs that do not change with the number of sales made.

Variable Cost

Expenses that change in proportion to the activity or volume of business, such as materials and labor.

Q8: What was the fixed manufacturing overhead budget

Q13: The present value of a given sum

Q15: The cost associated with idle time should

Q16: Analytical procedures involve:<br>A) the investigation of identified

Q19: The denominator activity represents the actual level

Q23: The following information is available on

Q31: An example of a program change control

Q42: Discuss the importance of the completeness assertion

Q54: The equivalent units for material for the

Q55: The absolute profitability of a segment is