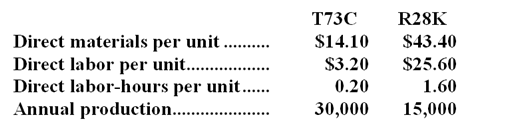

Latting Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, T73C and R28K, about which it has provided the following data: The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

The company's estimated total manufacturing overhead for the year is $1,526,700 and the company's estimated total direct labor-hours for the year is 30,000.

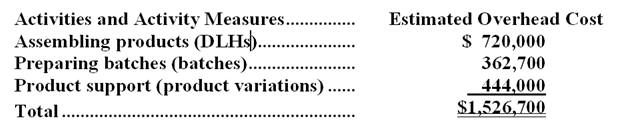

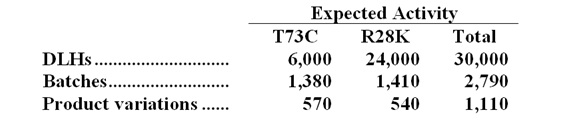

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The manufacturing overhead that would be applied to a unit of product R28K under the activity-based costing system is closest to:

Definitions:

Form 1040

The customary Internal Revenue Service (IRS) document utilized by individuals for the purpose of filing their annual earnings tax returns.

Tax Rate Structure

The dividing of taxable income into sections (brackets), each of which is taxed at a different rate.

Progressive

A term used to describe a tax system where the tax rate increases as the taxable income increases.

Proportional

A concept where elements are in a constant relationship in terms of size, amount, or number relative to a whole.

Q55: Expected cash collections in December are:<br>A)$59,400<br>B)$140,000<br>C)$199,400<br>D)$200,000

Q78: More Company has two divisions,L and M.During

Q79: Fixed costs that are traceable to a

Q106: The cleaning equipment and supplies in the

Q121: The facility expenses in the flexible budget

Q126: What is the overhead cost assigned to

Q127: How much indirect factory wages and factory

Q133: Last year,Salada Corporation's variable costing net operating

Q147: The labor rate variance for September is:<br>A)$1,470

Q182: The ARB Company has two divisions: Electronics