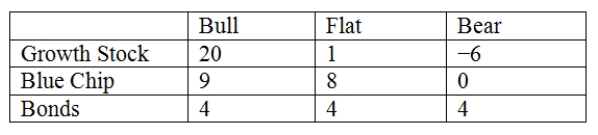

An investor is looking at three possible investments: growth stock,blue chip stock,or municipal bonds.The investment performance will vary depending on the investment market condition of bull (market rising),flat,or bear (market falling).The investment return for each investment for the corresponding market conditions is given below.  Which investment would the investor select if using the maximin criterion?

Which investment would the investor select if using the maximin criterion?

Definitions:

Halo Effect

A cognitive bias in which the perception of one positive characteristic of a person influences the overall perception of them as favorable.

Phi Phenomenon

An optical illusion of perceived motion created by the rapid succession of images or objects.

Recency Effect

The tendency to remember the most recently presented information best, compared to earlier information.

Consistency

The quality of achieving a level of uniformity, reliability, or steadiness in a given context or over time.

Q11: The Wilcoxon rank sum test requires that

Q14: The Laspeyres index and the Paasche index

Q20: Alternatives 1 and 2 in the following

Q32: The no-trend time series model is given

Q34: Alternatives 1 and 2 in the following

Q35: Since a(n)_ index employs the base-period quantities

Q71: If the decision maker has no knowledge

Q95: When the assumption of _ residuals (error

Q95: In general,a multiple regression model is considered

Q136: The point estimate of the variance in