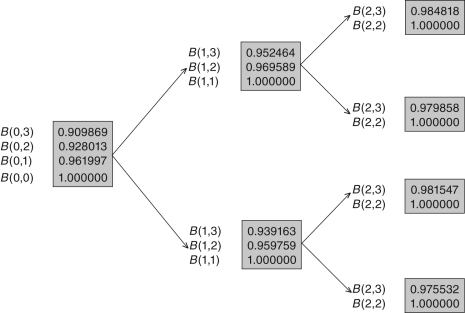

Use the fact that the pseudo-probability of default at time zero is (1 / 2) to answer the questions that follow.

-Consider a forward rate agreement (FRA) with maturity date 2.What is the FRA rate on this contract at time 0?

Definitions:

Welfare Banks

Financial institutions or programs designed to support low-income individuals or families, offering services like microloans or savings accounts with beneficial terms.

Financial Services

Economic services provided by the finance industry, including banking, insurance, investment management, and securities trading.

Public Assistance

Public assistance refers to government programs that provide financial aid to individuals or families in need, often based on income or other eligibility criteria.

Income Generation

The process through which an individual, company, or economy produces money or goods and services that can lead to income.

Q2: The stock market has been fluctuating widely,and

Q3: Consider a forward rate agreement (FRA)with maturity

Q3: Which of the following class of arbitrage

Q6: If the price of a zero-coupon bond

Q7: When a company undertakes risky ventures,who are

Q8: Which of the following was NOT a

Q10: Suppose that you trade a forward contract

Q12: The primary function of the Options Clearing

Q13: Use the discrete time model of the

Q18: Why was Black's model not useful for