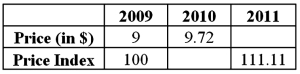

Exhibit 19-3.Consider the following information about the price and the price index of a popular book over three years.  Refer to Exhibit 19-3.If the price index in 2011 was 95 instead of 111.11,it would imply that:

Refer to Exhibit 19-3.If the price index in 2011 was 95 instead of 111.11,it would imply that:

Definitions:

Qualified Status

A designation indicating that a plan, typically a retirement plan, meets the requirements set by the IRS to receive tax advantages.

Roth IRA

A retirement savings account that allows your money to grow tax-free, with qualified withdrawals in retirement being tax-free as well.

Deductible Contribution

An investment or payment that can be subtracted from one's gross income to reduce taxable income, often related to retirement accounts or charitable donations.

Tax-Advantaged Status

Financial accounts or investments that receive favorable tax treatment, such as deductions or tax-free growth.

Q8: Although their jobs are much less prestigious,middle-class

Q12: Exhibit 18.2.The following table includes the information

Q23: High-stakes testing has been<br>A)praised for holding all

Q32: As evidence that African American children are

Q52: The _ method is a smoothing technique

Q54: If the price index for a particular

Q60: Exhibit 17.4.A researcher wants to examine how

Q75: Consider the following table that provides the

Q82: Jones Inc. ,a company manufacturing drills,earned a

Q88: A career counselor is comparing the annual