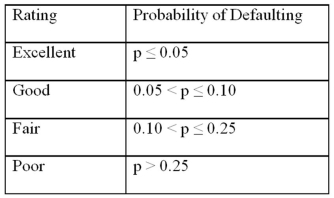

Exhibit 17.9.A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank.The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability,she decided to use the logistic model:

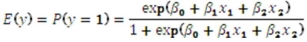

To estimate this probability,she decided to use the logistic model:  ,

,

where,

y = a binary response variable with value 1 corresponding to a default,and 0 to a no default,

x1 = the ratio of the credit card balance to the credit card limit (in percent),

x2 = the ratio of the total debt to the annual income (in percent).

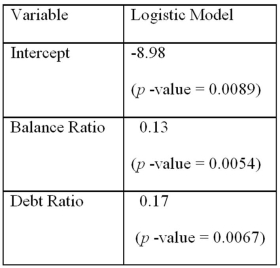

Using Minitab on the sample data,she arrived at the following estimates:  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Refer to Exhibit 17.9.Compute the predicted probability of defaulting for a person whose balance ratio is 5% and debt ratio is 30%.

Definitions:

Silver Acetate

A chemical compound with the formula AgC2H3O2, used in plating and as a photographic agent.

NaCl

Sodium chloride, commonly known as table salt, an ionic compound consisting of sodium and chloride ions.

AgCl

Silver chloride, a white crystalline solid that is photosensitive and less soluble in water.

Spectator Ions

Ions that are present in a chemical reaction but do not participate in it, remaining unchanged throughout the reaction.

Q8: Exhibit 17.7.To examine the differences between salaries

Q19: Exhibit 12.4 In the following table,likely voters'

Q32: Exhibit 20.12.A magician has a coin that

Q42: Exhibit 15-4.A researcher analyzes the factors that

Q42: Exhibit 20.7.A marketing firm needs to replace

Q46: The nonparametric test for two population medians

Q56: Multicollinearity is suspected when<br>A)there is a low

Q81: A manager at a ski resort in

Q95: Exhibit 15-8.A real estate analyst believes that

Q95: Calculate the nominal percent return from an