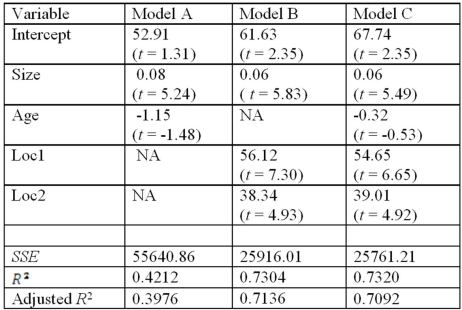

Exhibit 17.8.A realtor wants to predict and compare the prices of homes in three neighboring locations.She considers the following linear models:

Model A: Price = β0 + β1Size + β2Age + ε,

Model B: Price = β0 + β1Size + β2Loc1 + β3Loc2 + ε,

Model C: Price = β0 + β1Size + β2Age + β3Loc1 + β4Loc2 + ε,

where,

Price = the price of a home (in $thousands),

Size = the square footage (in square feet),

Loc1 = a dummy variable taking on 1 for Location 1,and 0 otherwise,

Loc2 = a dummy variable taking on 1 for Location 2,and 0 otherwise.

After collecting data on 52 sales and applying regression,her findings were summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Refer to Exhibit 17.8.Which of the three models would you choose to make the predictions of the home prices?

Definitions:

Risk Sharing and Transfer Agreements

Contracts where two or more parties agree to distribute among themselves the losses or benefits arising from particular risks.

Monte Carlo Simulation

A computational algorithm that uses repeated random sampling to obtain numerical results, typically used to assess risk and uncertainty in prediction and modeling.

Contingency Funds

Reserved money set aside by organizations or projects to address unforeseen events or emergencies that may incur additional costs.

Risk Profile

A risk profile is a quantified analysis of the types of threats an organization, asset, project, or individual faces, focusing primarily on the risk exposure level.

Q13: Exhibit 20.8.A sports agent wants to understand

Q35: In a simple linear regression model,if the

Q41: Asians,Hispanics,and African Americans grow up in families

Q43: Exhibit 18.2.The following table includes the information

Q46: A manager at a local bank analyzed

Q55: Consider the following table providing the prices

Q68: Exhibit 17.1.A researcher has developed the following

Q79: The number of dummy variables representing a

Q87: In the estimation of a multiple regression

Q90: Exhibit 12.4 In the following table,likely voters'