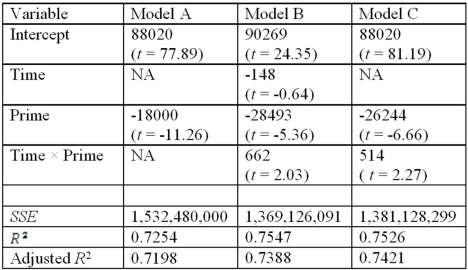

Exhibit 17.4.A researcher wants to examine how the remaining balance on $100,000 loans taken 10-20 years ago depends on whether the loan was a prime or sub-prime loan.He collected a sample of 25 prime loans and 25 sub-prime loans and records the data in the following variables: Balance = the remaining amount of loan to be paid off (in dollars) ,

Time = the time elapsed from taking the loan,

Prime = a dummy variable assuming 1 for prime loans,and 0 for sub-prime loans.

The regression results obtained for the models:

Model A: Balance = β0 + β1Prime + ε

Model B: Balance = β0 + β1Time + β2Prime + β3Time × Prime + ε

Model C: Balance = β0 + β1Prime + β2Time × Prime + ε,

Are summarized below.  Note.The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note.The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Refer to Exhibit 17.4.Which of the three models would you choose to make the predictions of the remaining loan balance?

Definitions:

Operating Synergy

The increased efficiency or added value that results when two companies combine their operations.

Economies of Scales

Cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output generally decreasing with increasing scale.

Restructuring

The process of restructuring a company's legal, ownership, operational, or other configurations to enhance its profitability or to better suit its current requirements.

Termination

involves the formal process of ending the employment or contractual relationship with an individual or entity, often due to performance issues, restructuring, or economic constraints.

Q1: Exhibit 15-7.A manager at a local bank

Q12: Consider the following table.It provides the price

Q33: Given the following portion of regression results,which

Q37: Exhibit 20.13.An energy analyst wants to test

Q37: The restricted model is a reduced model

Q39: The correlation coefficient can only range between

Q54: The centered moving average CMA,applied in the

Q73: A quadratic regression model is a special

Q77: The test statistic for the sign test

Q97: Exhibit 15-8.A real estate analyst believes that