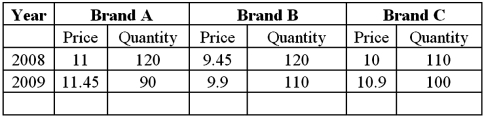

Consider the following table.It provides the price and quantity data for three brands of a good.

a.Compute the weighted aggregate price index using the Laspeyres method with 2008 as the base year.

B)Compute the weighted aggregate price index using the Paasche method with 2008 as the base year.

C)Suppose the new price and quantity data was available for the base year of 2000 instead of 2008.Would this lead to a substantial difference between the two indices? Explain your answer.

Definitions:

Naturalization Act

A U.S. law enacted to establish the process for immigrants to become American citizens, subject to changes and revisions over time.

Citizenship

The status of being a legal member of a particular country or nation-state, encompassing both rights provided by the state and duties expected from the individual.

Slaves

Individuals forced into servitude, denied personal freedom and rights, and compelled to work without pay.

1790

A year significant for the initiation of the first United States Census, marking a foundational aspect of the country's demographic record-keeping.

Q2: How are social capital and social networking

Q20: According to Doob,a supplier factory for Reebok

Q25: Exhibit 20.9.A shipping company believes there is

Q32: Exhibit 18.3.The following table shows the annual

Q38: Exhibit 17.9.A bank manager is interested in

Q50: When estimating a multiple regression model based

Q68: A simple linear regression, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="A

Q87: Exhibit 18.7.The following table shows the annual

Q91: For the linear probability model y =

Q93: For the logarithmic model y = β<sub>0</sub>