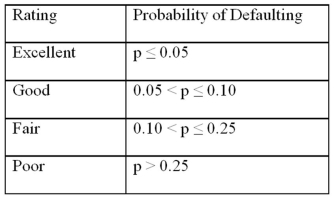

Exhibit 17.9.A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank.The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability,she decided to use the logistic model:

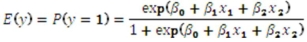

To estimate this probability,she decided to use the logistic model:  ,

,

where,

y = a binary response variable with value 1 corresponding to a default,and 0 to a no default,

x1 = the ratio of the credit card balance to the credit card limit (in percent),

x2 = the ratio of the total debt to the annual income (in percent).

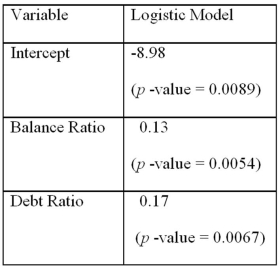

Using Minitab on the sample data,she arrived at the following estimates:  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Refer to Exhibit 17.9.Assuming the debt ratio 30%,compute the increase in the probability of defaulting when the balance ratio goes up from 5% to 15%.

Definitions:

Nonpersonal Communication

Any form of message dissemination that does not involve direct personal contact, including mass media advertising, sales promotions, and public relations.

Identified Sponsor

In advertising, a sponsor whose name and identity is known and disclosed in the message to inform or persuade the audience.

Advertising

The action of calling public attention to products, services, needs, etc., through paid announcements by an identified sponsor.

Pioneering

The act of being among the first to explore, develop, or adopt new techniques, areas of knowledge, or technology.

Q21: Exhibit 18.3.The following table shows the annual

Q25: Exhibit 18.1.The past monthly demands are shown

Q26: When the predicted value of the response

Q42: Consider the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q52: Exhibit 17.2.To examine the differences between salaries

Q53: An analyst examines the effect that various

Q59: When using Fisher's least significant difference (LSD)method

Q62: Exhibit 18.6.Based on quarterly data collected over

Q77: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q92: Consider the following simple linear regression model: