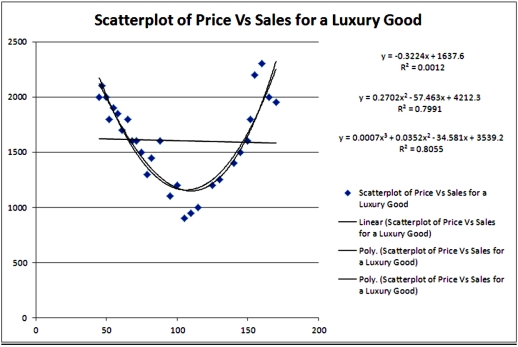

Exhibit 16.2.Typically,the sales volume declines with an increase of a product price.It has been observed,however,that for some luxury goods the sales volume may increase when the price increases.The following Excel output illustrates this rather unusual relationship.  Refer to Exhibit 16.2.What can be said about the linear relationship between Price and Sales?

Refer to Exhibit 16.2.What can be said about the linear relationship between Price and Sales?

Definitions:

Consumption Tax

A tax on the purchase of goods or services, levied at the point of sale, designed to tax spending rather than income or savings.

Encourage Consumption

Measures or strategies aimed at increasing consumer spending and demand for goods and services.

Federal Income Tax

A tax levied by the federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Ability-To-Pay Principle

A taxation principle that suggests taxes should be levied according to an individual's or entity's ability to pay, favoring a more equitable distribution of the tax burden.

Q2: If units with each block are randomly

Q14: Exhibit 13.1 The following is an incomplete

Q41: Exhibit 13.7 A market researcher is studying

Q44: Exhibit 20.3.A company which produces financial accounting

Q50: Which of the following models is not

Q60: When testing whether the correlation coefficient differs

Q65: Exhibit 16-7.It is believed that the sales

Q73: The chi-square test of a contingency table

Q85: A portfolio manager is interested in reducing

Q93: In the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="In