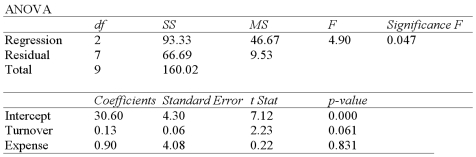

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate and its expense ratio.She randomly selects 10 mutual funds and estimates: Return = β0 + β1 Turnover + β2 Expense + ε,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and ε is the random error component.A portion of the regression results is shown in the accompanying table.

Definitions:

Main Idea

The central or most important thought, concept, or argument that is being conveyed in a text or discourse.

Request For Action

A directive or plea issued to prompt someone to take a specific action or make a decision.

Expression Of Appreciation

A statement or gesture showing gratitude or acknowledgment of others' efforts or achievements.

Straightforward Statement

A clear, direct, and unambiguous declaration that conveys information or expresses a point without complexity.

Q8: Exhibit 17.7.To examine the differences between salaries

Q13: A farmer plants tomato seeds into four

Q13: Which of the following set of hypotheses

Q37: If the number of dummy variables representing

Q53: Exhibit 16.5.The following data shows the demand

Q59: The sample standard deviation of the monthly

Q83: Exhibit 12.3 A fund manager wants to

Q106: Exhibit 15-1.An marketing analyst wants to examine

Q108: Exhibit 17.8.A realtor wants to predict and

Q111: In a simple linear regression based on