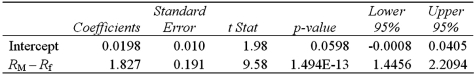

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

Refer to Exhibit 15-6.You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses:

Definitions:

Target Cash Balance

The desired cash balance that a firm plans to maintain in order to conduct business.

Seasonal Patterns

Seasonal patterns are recurring fluctuations in data or activity levels that occur at specific times of the year.

Unanticipated Fluctuations

These are unexpected changes in financial markets, economic conditions, or company specifics that can influence financial outcomes.

Inventory Management

The practice of ordering, storing, tracking, and controlling inventory to ensure the availability of products while minimizing costs and storage space.

Q1: A researcher analyzes the relationship between amusement

Q1: The values of the <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="The

Q12: Exhibit 11-6.A financial analyst examines the performance

Q25: Exhibit 11-3.The following are the competing hypotheses

Q49: How does the width of the interval

Q60: A researcher gathers data on 25 households

Q81: Consider the following simple linear regression model:

Q85: Use the F table to approximate the

Q89: In which of the following situations is

Q95: Exhibit 12.2 A university has six colleges