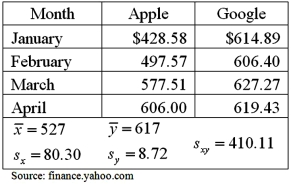

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

B)Specify the competing hypotheses in order to determine whether the stock prices are correlated.

C)Calculate the value of the test statistic and approximate the corresponding p-value.

D)At the 5% significance level,what is the conclusion to the test? Explain.

Definitions:

Flexible Budget

A flexible budget that varies according to activity or volume changes.

Direct Labor

The labor costs directly attributable to the production of goods or services, including wages for workers who are physically involved in creating a product.

Planning Budget

A comprehensive financial plan formulated for a set period, outlining projected revenues, expenses, and resource allocations.

Occupancy Expenses

Costs associated with occupying a physical space, such as rent, utilities, and property taxes.

Q1: A researcher analyzes the relationship between amusement

Q12: The equation y = β<sub>0</sub> + β<sub>1</sub>x

Q17: A binary choice model can be used,for

Q37: Exhibit 12.4 In the following table,likely voters'

Q50: When estimating a multiple regression model based

Q56: The fit of the models y =

Q58: A career counselor wants to determine if

Q66: A fund manager suspects there is an

Q75: Exhibit 16-4.The following data shows the cooling

Q94: It is generally believed that no more