An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate and its expense ratio.She randomly selects 10 mutual funds and estimates: Return =  +

+  Turnover +

Turnover +  Expense +

Expense +  ,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and

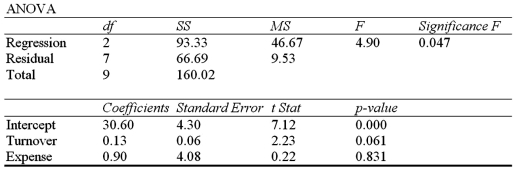

,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and  is the random error component.A portion of the regression results is shown in the accompanying table.

is the random error component.A portion of the regression results is shown in the accompanying table.  a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

a.Predict the return for a mutual fund that has an annual holdings turnover of 60% and an annual expense ratio of 1.5%.

B)Interpret the slope coefficient attached to Expense.

C)Calculate the standard error of the estimate.If the sample mean for Return is 34.7%,what can you infer about the model's predictive power.

D)Calculate and interpret the coefficient of determination.

Definitions:

Report Wealth

The act of declaring or disclosing one's financial assets and resources.

National Wealth

The total value of all financial assets and resources owned by a country's government, businesses, and individuals.

Richest 1%

The segment of the population that holds the largest share of wealth, often involved in significant economic and policy-making decisions.

Americans

Denotes the citizens or people of the United States of America.

Q2: Exhibit 16-4.The following data shows the cooling

Q4: Exhibit 13.8 A market researcher is studying

Q12: Exhibit 17.7.To examine the differences between salaries

Q23: Exhibit 17.8.A realtor wants to predict and

Q26: A 99% confidence interval for the population

Q33: Exhibit 10.1 A farmer uses a lot

Q33: Exhibit 17.9.A bank manager is interested in

Q42: The linear trend, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="The linear

Q59: The sample standard deviation of the monthly

Q78: Exhibit 17.8.A realtor wants to predict and