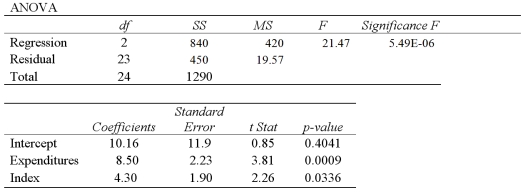

A sociologist studies the relationship between a district's average score on a standardized test for 10th grade students (y),the average school expenditures per student (x1 in $1000s),and an index of the socioeconomic status of the district (x2).The results of the regression are:

A)Predict a district's average test score if average expenditures are $4,500 and the district's social index is 8.

B)Interpret the slope coefficient attached to Expenditures.

C)Calculate the standard error of the estimate.

D)Calculate and interpret the coefficient of determination.

E)Calculate the adjusted  .

.

Definitions:

Effective Annualized Rate

The interest rate on an investment or loan on an annual basis, taking compounding into account.

Inflation

The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Effective Interest Rate

The actual annual interest rate that an investor earns or pays, taking into account the effect of compounding over the period.

GICs

Guaranteed Investment Certificates, a secure investment that guarantees to preserve the principal amount while offering a fixed interest rate over a specified period.

Q2: Packaged candies have three different types of

Q12: Exhibit 13.2 A researcher with Ministry of

Q13: For a chi-square goodness-of-fit test,the expected category

Q14: Consider the model y = β<sub>0</sub> +

Q43: A scatterplot can help determine if two

Q57: A regression equation was estimated as <img

Q66: Exhibit 17.3.Consider the regression model, Humidity =

Q75: Exhibit 12.4 In the following table,likely voters'

Q98: Exhibit 18.7.The following table shows the annual

Q101: Exhibit 14-8.An real estate analyst believes that