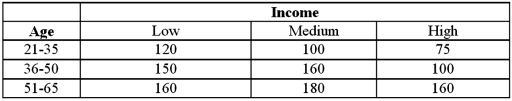

Exhibit 12.5 In the following table,individuals are cross-classified by their age group and income level.  Refer to Exhibit 12.5.Assuming age group and income are independent,the expected 'low income and 21-35 age group' cell frequency is:

Refer to Exhibit 12.5.Assuming age group and income are independent,the expected 'low income and 21-35 age group' cell frequency is:

Definitions:

Kemp-Roth Tax Cut

A significant federal tax reduction in the US that was passed in 1981, aimed at encouraging economic growth by reducing individual income tax rates.

Federal Personal Income Tax

A tax levied by the U.S. federal government on the annual income of individuals, with rates varying based on income level.

President's Budget

An annual proposal by the U.S. President outlining the government's planned financial activities and spending for the upcoming fiscal year.

Office of Management and Budget

A federal office within the Executive Branch of the United States government that assists the President in preparing the budget and monitoring federal agencies.

Q20: Exhibit 13.6 A researcher wants to understand

Q31: Exhibit 16-1.The following Excel scatterplot with the

Q33: At a particular academically challenging high school,the

Q33: Two students,Mary and Joanna,in a Statistics class

Q39: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="When estimating

Q50: For the goodness-of-fit test for normality to

Q71: In a multiple regression based on 30

Q86: The null hypothesis in a hypothesis test

Q111: In an examination of purchasing patterns of

Q115: Exhibit 15-8.A real estate analyst believes that